I. Introduction

If you’ve ever opened your banking app after a “treat yourself” weekend and wondered why the glow faded faster than your balance, you’re not alone. We’re told that happiness is hiding in the next purchase, the bigger upgrade, the nicer neighborhood. Yet so many of us are spending more than ever and feeling… less. Less calm. Less free. And Less ourselves.

This guide is for anyone who suspects there’s another way. “Living well on less” isn’t code for self-denial or beige austerity. It’s a practical, joyful re-centering of life around what actually matters: relationships, meaning, creativity, health, and time. It’s the relief that comes from fewer decisions and clearer priorities. and It’s savoring the morning sun on a walk, a laugh-filled dinner made at home, the quiet satisfaction of using what you already have.

Over the next sections, we’ll rethink the tired money-equals-happiness equation and look at what research really says about well-being. We’ll explore simple mindset shifts—like clarifying your why and practicing everyday gratitude—that make frugality feel like freedom, not sacrifice. Then we’ll get concrete: value-driven budgeting you can actually stick with, mindful spending questions that stop impulse buys in their tracks, and decluttering tactics that return both cash and calm.

You’ll also find a treasury of low-cost joys (from nature to neighborhood to nourishing routines), real-life stories of people who traded “more stuff” for “more life,” and strategies for navigating common obstacles—social pressure, family buy-in, and the awkward transition period when old habits meet new priorities. We’ll close with gentle systems for staying on track and using the savings you create to buy something priceless: flexibility, options, and time.

You don’t need a windfall to feel rich. You need alignment—between your values, your calendar, and your money. Start here, take one small step today, and let the momentum build. Living well on less isn’t just possible; it’s surprisingly delightful. Let’s begin.

II. Rethinking Wealth and Happiness

A. The Science of Joy and Money

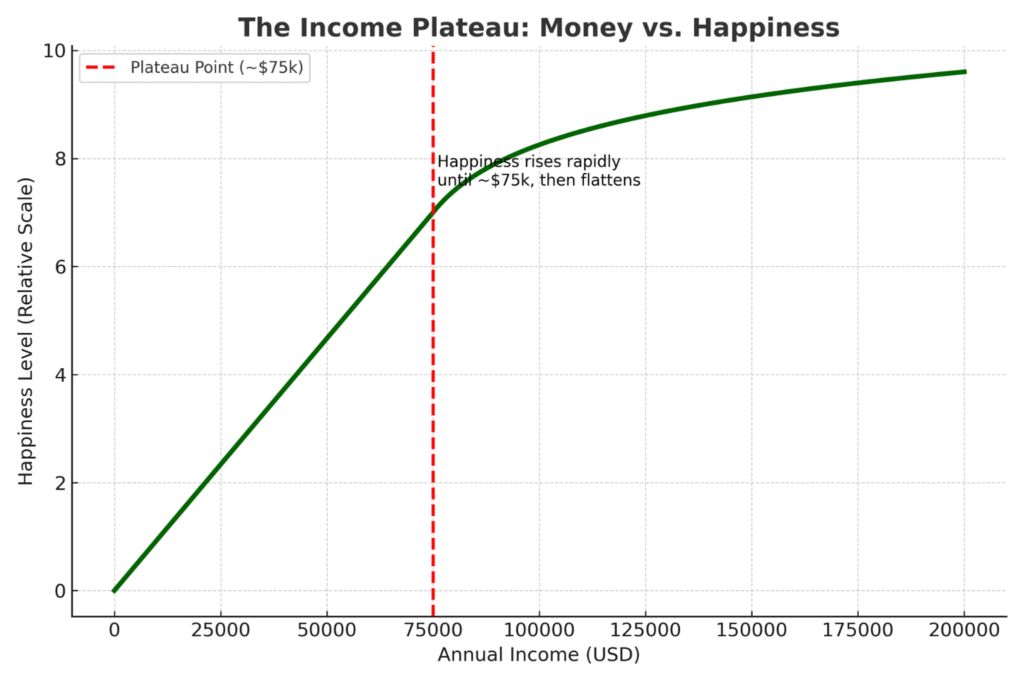

Economists call it the income plateau: each additional dollar brings less joy than the one before.

For decades, researchers have studied the link between money and happiness. The results are clear but often misunderstood. Yes, having enough income to meet basic needs—food, shelter, healthcare, safety—does correlate with higher life satisfaction. But beyond that threshold, the effect tapers off dramatically. Economists call it the income plateau: each additional dollar brings less joy than the one before.

A well-cited study from Princeton University found that happiness rises with income only up to a comfortable baseline (around $75,000 in the U.S., adjusted for cost of living). After that, people with higher incomes are not significantly happier than those just below them. More recent research from McGill University has reinforced the same conclusion: once basic comfort is covered, factors like community, trust, social support, and purpose play a far greater role in well-being than bank balance.

In other words, money matters—but not nearly as much as marketers would have us believe.

B. Why Experiences Beat Things

If you’ve ever splurged on a new gadget only to feel the thrill fade within days, you’ve experienced the hedonic treadmill—our tendency to quickly return to a baseline level of happiness despite gains. Compare that with a shared meal with friends, a spontaneous trip to the park, or even an afternoon learning a new skill. Research consistently shows that experiences bring more lasting joy than material purchases.

Why? Experiences become part of our story. They’re social, memory-rich, and often tied to personal growth. A bookshelf of unread books is clutter; an afternoon spent immersed in one story is nourishment. A closet of impulse buys may weigh you down; a weekend hike frees you. Living with less clears the stage for more experiences—and more meaning.

C. Values as the New Currency

Living well on less isn’t about deprivation; it’s about alignment. The most satisfied people aren’t the ones with the most possessions—they’re the ones whose money and time reflect their deepest values.

Think of values as your north star. Maybe yours include family, creativity, contribution, or health. Once those are clear, financial decisions become less about “Can I afford it?” and more about “Does this support what matters most?”

This is where the minimalist mantra “own less, live more” takes root. Cutting back on the unnecessary—whether it’s excess subscriptions, gadgets, or even obligations—creates the space, time, and funds to invest in what lights you up.

Key Takeaway

Happiness isn’t about stretching your paycheck to chase every shiny thing. It’s about recognizing that wealth = well-being, and well-being comes from experiences, alignment, and community more than from income. By reframing wealth in this way, frugality transforms from restriction into empowerment—a conscious decision to live richly in non-material ways.

III. The Foundation: Mindset Shifts for Joyful Frugality

A. Clarify Your “Why”

Every lasting change begins with purpose. Without a clear “why,” frugality can feel like punishment; with one, it becomes freedom. Ask yourself: What do I really want from this season of my life?

For some, it’s the peace of being debt-free. For others, it’s the flexibility to work less and spend more time with family. Maybe it’s building a safety net that makes life less stressful—or simply creating space to slow down and savor.

Take ten minutes to write down your top three reasons for wanting to live well on less. Put them somewhere visible—on your fridge, your phone’s lock screen, or a sticky note on your wallet. When temptation strikes, glance at that reminder. It turns every “no” to an impulse purchase into a “yes” for something bigger.

B. Gratitude as a Joy Multiplier

Frugality without gratitude can feel like lack. Gratitude turns it into abundance. Numerous studies show that regularly practicing gratitude rewires the brain to focus on sufficiency rather than scarcity.

Practical, no-cost gratitude exercises:

- The Three Good Things Journal: Each evening, write down three things you appreciated that day. They don’t need to be big—a good laugh, a warm meal, a moment of quiet counts.

- Gratitude Walks: Take a walk and mentally note everything around you you’re thankful for. It grounds you in the present.

- The “Already Have” List: Instead of writing what you want, write a list of what you already own, know, and experience that enriches your life.

These simple practices shift focus from what’s missing to what’s present. Over time, this mindset makes resisting the pull of consumerism less about willpower and more about contentment.

C. Embrace the Hidden Benefits

Living on less often reveals unexpected perks that go far beyond saving money:

- Creativity blooms. A tight budget encourages you to cook new meals, repurpose old items, or invent free family traditions.

- Relationships deepen. Shared potlucks, game nights, or walks replace pricey outings with more connection.

- Simplicity brings peace. Fewer possessions mean less clutter, less cleaning, and less decision fatigue.

When you start noticing these hidden gifts, frugality shifts from being a constraint to being a catalyst for joy. Many people find themselves saying not “I have to cut back” but “I get to live differently.”

Key Takeaway

Mindset is the foundation of joyful frugality. Clarifying your “why” gives direction, gratitude reframes scarcity into abundance, and hidden benefits reveal that living with less often means living with more of what truly matters.

IV. The Practical Framework: Systems for Living Well on Less

A. Value-Driven Budgeting

Budgeting often gets a bad reputation as restrictive or joyless, but in truth, a budget is simply a tool for alignment. Done well, it doesn’t just track numbers—it ensures that your money actively supports your values.

One of the most effective methods is zero-based budgeting. In this approach, every dollar is assigned a role: groceries, housing, savings, hobbies, generosity. Nothing is left unaccounted for. Rather than a vague goal of “spend less,” you create a purposeful plan where each expense has to justify its place.

To make this work in practice:

- List your core values. Family, health, creativity, freedom—whatever matters most.

- Write out your monthly income. Assign every dollar to categories that reflect those values.

- Be realistic. Don’t cut all entertainment if community time is important to you—just redefine it (game nights over pricey dinners).

- Review monthly. Ask: Did my money reflect my priorities? If not, adjust.

A simple worksheet or even a notebook can be enough. The goal is not rigid perfection but clarity: knowing that your financial life supports what brings real joy.

B. The Art of Mindful Consumption

Frugality isn’t just about how you budget—it’s about how you choose. Every purchase is a decision, and decisions accumulate into lifestyles. Practicing mindful consumption helps you make choices that feel good long after the receipt fades.

Key strategies:

- The Pause Rule: Wait 24–48 hours before non-essential purchases. This disrupts impulse buying and gives you space to evaluate.

- The Three Questions Test: Before you buy, ask: Do I need this? Will I use this often? Does it align with my values? If the answer is “no” or “not really” to any, consider passing.

- Wants vs. Values-Aligned Desires: Wants are fleeting (“That gadget looks cool”). Values-aligned desires serve a deeper goal (“This tool will help me spend more time cooking at home”).

- Unsubscribe & Simplify: Remove marketing triggers—unfollow brand accounts, unsubscribe from sales emails, and delete shopping apps if needed.

Mindful consumption isn’t about austerity—it’s about ensuring every “yes” feels worth it. Over time, you’ll notice fewer regrets, less clutter, and more satisfaction from the things you do keep.

C. Decluttering as a Financial & Emotional Tool

We often underestimate the hidden costs of excess stuff. Every item you own requires some combination of money, time, space, or mental energy. Decluttering frees all four.

Immediate financial benefits:

- Sell unwanted items online or locally—extra cash can go toward savings or paying off debt.

- Cancel duplicate services or unused subscriptions uncovered in a household “audit.”

Long-term savings:

- Less clutter reduces the urge to “organize by buying more bins.”

- A smaller wardrobe cuts laundry and replacement costs.

- Fewer gadgets = fewer repairs and upgrades.

Emotional clarity:

Decluttering clears not just closets but also mental fog. A pared-down environment reduces decision fatigue and stress, creating more calm at home.

Getting started:

- Choose one small area (a drawer, a shelf) to build momentum.

- Use the “keep, donate, sell, recycle” method.

- Commit to regular check-ins—seasonal reviews work well.

Think of decluttering as an act of financial hygiene and emotional reset, not a one-time purge. Each step creates breathing room for what truly matters.

Key Takeaway

Systems make frugality sustainable. Budgeting aligns money with values, mindful consumption reduces regret and clutter, and decluttering creates both financial and emotional space. Together, they shift frugality from a restriction into a supportive framework for joyful living.

V. Low-Cost Joy: Activities and Lifestyle Shifts

One of the biggest misconceptions about living frugally is that it’s all about cutting back. In reality, it’s about trading up—swapping expensive, fleeting pleasures for more enduring, nourishing forms of joy. Here are four categories of low-cost or free activities that prove you don’t need to spend much (or anything at all) to live richly.

A. Nature-Based Joy

The outdoors is one of life’s most generous gifts. Countless studies link time in nature to reduced stress, better sleep, and improved mood—yet many of these benefits are completely free.

Simple ideas:

- Hiking & Walking Trails: Whether it’s a national park or a local path, nature walks cost nothing but time.

- Picnics & Stargazing: Swap restaurant meals for picnic blankets and night skies. Both create lasting memories at a fraction of the cost.

- Gardening: Even a balcony herb garden offers therapeutic rewards and reduces grocery bills.

- Seasonal Traditions: Think sledding in winter, cherry blossom walks in spring, outdoor concerts in summer, leaf-peeping in autumn. Anchoring your calendar to natural rhythms fosters joy without relying on shopping seasons.

Nature gives you perspective and peace, reminding you that the best things in life aren’t bought—they’re experienced.

B. Creative & Learning Pursuits

Consumer culture tells us entertainment requires subscriptions, tickets, or gadgets. In truth, creativity and curiosity are among the most affordable sources of joy.

Ideas to explore:

- Library Resources: Beyond books, libraries often offer free workshops, maker spaces, movies, and even equipment rentals.

- Skill Swaps: Trade knowledge with friends or neighbors—teach someone a recipe in exchange for learning guitar chords.

- DIY & Hobbies: Drawing, writing, cooking, photography, sewing, woodworking—many start with supplies you already have.

- Free Online Learning: Platforms like Coursera, YouTube, and Khan Academy provide thousands of courses at no cost.

The point isn’t mastery—it’s engagement. When your hands and mind are busy creating, the need for constant consumption naturally fades.

C. Community & Social Connection

Humans are wired for connection, yet socializing is often equated with expensive outings. In reality, shared joy doesn’t require shared bills.

Frugal, high-value social options:

- Potluck Dinners: Everyone brings a dish, creating abundance without strain.

- Walking Groups & Book Clubs: Free, consistent, and community-building.

- Volunteering: Gives a sense of meaning and connection while costing nothing.

- Neighborhood Resource Sharing: Tool libraries, Buy Nothing groups, and clothing swaps reduce expenses and deepen trust.

- Community Events: Many towns host free concerts, festivals, or open-air movie nights—check local calendars.

Frugal living can actually strengthen relationships. When money isn’t the default way of connecting, creativity and genuine presence step in.

D. Self-Care & Wellness

Wellness industries often profit from selling expensive solutions to stress. But the core of self-care is simplicity, not spending.

Accessible practices:

- Home Workouts: Bodyweight routines, yoga videos, or dance sessions require no gym membership.

- Meditation & Mindfulness: Apps like Insight Timer (free version) or simply timed breathing exercises can lower anxiety.

- DIY Spa Treatments: Homemade scrubs (sugar + olive oil), warm baths, or skincare routines with basics on hand.

- Cooking as Therapy: Preparing nourishing meals at home is both meditative and cost-effective.

Self-care doesn’t have to mean buying candles and creams. At its best, it’s about honoring your body and mind with rest, nourishment, and intention.

Key Takeaway

Joy doesn’t live in store aisles—it thrives in experiences, creativity, connection, and self-care. By consciously shifting attention to these free or low-cost sources of happiness, you’ll not only save money but also deepen your sense of fulfillment.

VI. Real-Life Success Stories

Abstract advice is useful, but transformation feels real when you see it in practice. Here are three examples of people who chose to live well on less and found more freedom, joy, and meaning along the way.

1. The Young Family Who Swapped Restaurants for Rituals

Sam and Maya, parents of two, realized they were spending over $400 a month on takeout and casual dining. They set a challenge: no restaurants for one month, except birthdays. Instead, they created a weekly “family cooking night,” where each person picked a recipe and helped prepare it together.

Not only did they save money (about $3,500 in the first year), but they also built stronger connections around the table. Their kids began requesting “pizza night at home” over pizza delivery, and Friday dinners became a family ritual that everyone looked forward to. What started as a financial decision ended up reshaping their family culture.

2. The Solo Professional Who Downsized to Upgrade

Claire, a single graphic designer, found herself drained by the upkeep of a two-bedroom apartment filled with clothes, gadgets, and furniture she rarely used. After reading about minimalism, she decided to downsize to a smaller studio. She sold unused items online, netting nearly $2,000, and reduced her monthly rent by $400.

The surprising payoff wasn’t just financial. With less cleaning and clutter, Claire discovered more energy for her creative projects. She joined a local art co-op, made new friends, and began showcasing her work at community events. Downsizing didn’t feel like “less”—it opened the door to more life.

3. The Retiree Who Found Wealth in Community

After retiring, George worried about living on a fixed income. Instead of isolating himself, he leaned into community. He joined a neighborhood gardening club, volunteered at the library, and started hosting monthly board game nights at home.

His expenses dropped naturally: free produce from the garden, fewer trips to expensive outings, and more shared meals. But the biggest gain was emotional. Surrounded by friends and a sense of purpose, George reported feeling happier and more secure than he had during his high-earning years. His story illustrates that “wealth” often has less to do with dollars and more to do with connection.

Key Takeaway

Real people across life stages prove that frugality is not deprivation—it’s transformation. Whether you’re raising a family, navigating independence, or embracing retirement, living well on less is possible, powerful, and profoundly joyful.

VII. Overcoming Common Obstacles

Adopting a “live well on less” lifestyle sounds inspiring in theory, but the reality can be messy. Old habits, cultural norms, and even loved ones may push back. Anticipating these challenges makes it easier to navigate them with confidence and grace.

A. Social Pressure & FOMO

Modern culture equates success with consumption. Friends post vacations, colleagues upgrade cars, and advertisements whisper that happiness is one purchase away. Opting out can feel like opting out of belonging.

How to handle it:

- Reframe FOMO: Instead of “missing out,” remind yourself you’re choosing what matters more. That quiet weekend reading may not look flashy on Instagram, but it feeds your well-being.

- Curate your inputs: Reduce comparison triggers by unfollowing accounts that spark envy and following communities focused on simple living, sustainability, or frugality.

- Share your “why”: When people question your choices, a simple explanation (“I’m prioritizing savings for travel” or “I’m focusing on time with family”) reframes frugality as empowerment, not lack.

B. The Transition Period

Change rarely feels smooth at first. The early days of cutting back can trigger discomfort—old routines are disrupted, and the initial excitement can wear off. This is where many people give up, assuming they’ve failed.

How to handle it:

- Start small: Don’t overhaul your entire lifestyle in one week. Begin with one habit—like cooking at home three nights a week or doing a no-spend weekend—and build momentum.

- Expect discomfort: Recognize it’s normal to crave the convenience or excitement of old spending habits. Remind yourself: it’s not a setback, it’s part of the adjustment.

- Celebrate wins: Keep track of small victories, whether that’s $20 saved, a clutter-free drawer, or a fun free outing. Visible progress keeps motivation alive.

- Lean on community: Online groups, forums, or friends experimenting with frugality can provide encouragement during shaky moments.

C. Family & Relationship Dynamics

Perhaps the trickiest challenge is when your vision of frugal living collides with someone else’s habits—partners, kids, or extended family. Money is emotional, and lifestyle changes ripple outward.

How to handle it:

- Invite, don’t impose: Instead of dictating, frame frugality as an experiment. Suggest a family “fun on a budget” challenge or invite your partner to brainstorm values-based goals.

- Highlight benefits, not restrictions: Kids may balk at fewer toys, but they’ll embrace family game nights or camping trips. Partners may resist a tighter budget but get excited about the travel fund it enables.

- Find compromise: Agree on “splurge zones.” Maybe your partner keeps their streaming subscription while you cut back elsewhere. The goal isn’t perfect alignment but shared progress.

- Model values: Children learn more from what you do than what you say. When they see you grateful for simple joys, they’ll absorb the lesson.

Key Takeaway

Living well on less isn’t a straight path—it’s a journey through social pressure, personal discomfort, and relational dynamics. By reframing challenges as part of the process, starting small, and leaning on shared values, you turn obstacles into stepping-stones. The transition may be bumpy, but what waits on the other side—freedom, clarity, connection—is worth it.

VIII. Advanced Strategies for Long-Term Success

Frugality isn’t just about saving a few dollars here and there; practiced consistently, it becomes a lifestyle that creates long-term stability and even wealth. Once the basics are in place, these two advanced strategies can help deepen your practice and ensure the rewards keep compounding.

A. Financial Self-Care Routines

Money, like health, benefits from regular checkups. Just as you wouldn’t ignore your body for years and expect peak wellness, your financial life needs consistent attention.

Practical routines to adopt:

- Seasonal Reviews: Every three months, revisit your budget and values. Has your spending aligned with your priorities? Do adjustments need to be made?

- Annual Reset: Once a year, take a “money retreat”—a day or weekend to review big-picture goals, update savings plans, and reflect on whether your financial life supports the life you want.

- Celebrate Progress: Mark milestones, no matter how small. Paid off a credit card? Celebrate with a picnic. Finished a no-spend month? Journal what you learned. These rituals reinforce momentum.

- Course-Correct Gently: If you overspend, resist shame. Instead, ask: What triggered this? How can I plan differently next time? Self-compassion keeps you moving forward.

By treating finances as part of self-care, you replace guilt with empowerment. Money management shifts from a chore into a ritual of alignment.

B. Building Wealth Through Frugality

Frugality isn’t just about living within your means—it’s about creating means for the future. Every dollar you don’t spend is a dollar that can be saved, invested, or redirected toward freedom.

Strategies for turning savings into security:

- The Power of Living Below Your Means: Even a modest gap between income and spending creates powerful momentum. Saving 10–20% consistently builds resilience.

- Automate Savings: Direct part of each paycheck to savings or investment accounts before it hits your checking account. Out of sight, out of mind—yet steadily growing.

- Invest for the Long Term: Consider simple, low-fee index funds or retirement accounts that let your money compound over decades. The magic of compound interest means that even small amounts add up dramatically.

- Redirect “Cuts” into Growth: Cancelled a subscription? Redirect that $15 a month to a travel fund or retirement account instead of letting it vanish.

- Think Flexibility, Not Just Dollars: Building wealth isn’t only about numbers—it’s about options. The cushion you create through frugality gives you freedom to change jobs, move cities, or take time off without fear.

Frugality, when channeled into long-term habits, becomes more than a lifestyle—it’s a wealth-building engine.

Key Takeaway

Advanced frugality is less about cutting corners and more about creating systems. Through regular financial self-care and intentional wealth-building, you transform everyday savings into lifelong freedom.

IX. Conclusion: Your Journey Forward

We began with a simple but radical idea: joy doesn’t have a price tag. While money helps meet our needs, it isn’t the ultimate source of happiness. Research, stories, and lived experience all point to the same truth—community, purpose, gratitude, and alignment bring far more satisfaction than any shopping spree ever could.

Living well on less is not about deprivation; it’s about liberation. By clarifying your “why,” practicing gratitude, and embracing simplicity, you create a foundation of contentment. With supportive systems—budgeting, mindful consumption, and decluttering—you channel your resources toward what truly matters. Layer in low-cost joys, real-life inspiration, and strategies for overcoming obstacles, and frugality transforms from a financial tactic into a joyful lifestyle.

Most importantly, this path doesn’t just help you save—it helps you live. With fewer financial pressures, you gain freedom. With fewer possessions, you gain clarity. And with fewer distractions, you gain time for what matters most.

So where do you begin? Not with an overhaul, but with a single, intentional step. Try one practice today: write down your “why,” start a gratitude journal, or plan a no-spend afternoon filled with simple pleasures. Each choice plants a seed, and over time those seeds grow into a garden of joy, resilience, and freedom.

Remember: you don’t need more money to live richly. You need alignment between your values, your time, and your resources. The tools are here, the path is clear—the next step is yours.

X. Resources for Living Well on Less

Sometimes the best next step is simply knowing where to turn for inspiration, community, and practical tools. Here are curated resources to support your journey toward joyful frugality.

Books & Guides

- Your Money or Your Life — Vicki Robin & Joe Dominguez. A classic framework for transforming your relationship with money.

- The Joy of Less — Francine Jay. A friendly, practical guide to minimalism and decluttering.

- The Year of Less — Cait Flanders. A memoir of living on less that feels relatable and inspiring.

- Atomic Habits — James Clear. A powerful book on habit-building that supports sustainable lifestyle changes.

Websites & Blogs

- Mr. Money Mustache (mrmoneymustache.com) — witty, practical writing on financial independence and frugal living.

- Becoming Minimalist (becomingminimalist.com) — Joshua Becker’s blog on intentional living and simplicity.

- Frugalwoods (frugalwoods.com) — a family’s real-life journey into frugality and financial freedom.

- The Minimalists (theminimalists.com) — blog, books, and podcast exploring meaning over stuff.

Community & Tools

- Buy Nothing Project (buynothingproject.org) — hyper-local networks for sharing and gifting resources.

- Reddit r/Frugal (reddit.com/r/Frugal) — an active online community trading daily tips and support.

- YNAB (You Need a Budget) (youneedabudget.com) — a budgeting app focused on values-driven money management.

- Mint (mint.com) — free, user-friendly budgeting and tracking tool.

Research & Studies

- Kahneman & Deaton (2010) — Princeton study on income and happiness plateau (PNAS).

- Harvard Study of Adult Development (adultdevelopmentstudy.org) — 80+ year research showing strong relationships predict happiness more than wealth.

- World Happiness Report (worldhappiness.report) — annual global study of well-being factors beyond GDP.

Practical Free Resources

- Freecycle Network (freecycle.org) — online platform for giving and receiving free goods.

- Library of Congress Digital Collections (loc.gov/collections) — vast access to free books, music, and archives.

- Coursera, edX, Khan Academy — free and low-cost courses for skill-building and enrichment.

- National Parks Free Entrance Days (U.S.) (nps.gov) — days when all national parks waive entry fees.

Key Takeaway

You don’t have to walk this path alone. From classic books to modern communities, from research studies to free local resources, the world is rich with support for those who want to live well on less. Explore, experiment, and find the resources that resonate with you.